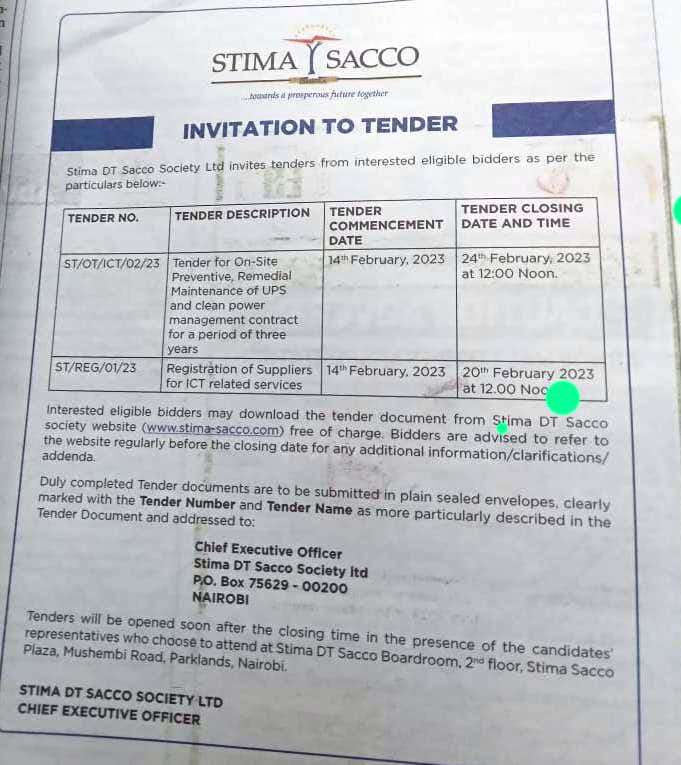

To confirm how unsafe members’ deposits are, CEO Stima Sacco Gamaliel Hassan with the advice of the board placed an advert in the Daily Nation newspaper yesterday calling on bidders to send their bids for “on-site preventive, remedial maintenance of UPS and clean power management contract for a period of three years”

Irate members of the struggling Stima Sacco are up in arms against the top brass at the Sacco Societies Regulatory Authority (SASRA) for turning a deaf ear to their plight. According to a section of Sacco members who talked to The Weekly Vision on strict condition of anonymity for fear of victimization, SASRA leadership under the chairmanship of George Kuria Murathe and CEO Peter Njuguna have failed to address the serious matter of system hacking yet they are responsible for the supervision and regulation of SACCO Societies in Kenya.

“It is unfortunate that despite three attempts to hack the system, SASRA has not moved in with speed to ensure our funds are safe’ said one member. Members are now calling on SARSA as well as other regulatory authorities to take immediate action and investigate this issue and hold those responsible accountable. Members have been living in fear after the system suffered a mysterious cyber-attack that saw hackers manage to compromise over 1,000 SIM cards in less than 30 minutes of the hacking.

To confirm how unsafe members’ deposits are, CEO Stima Sacco Gamaliel Hassan with the advice of the board placed an advert in the Daily Nation newspaper yesterday calling on bidders to send their bids for “on-site preventive, remedial maintenance of UPS and clean power management contract for a period of three years”. It just shows how serious the matter is and how urgent Stima Sacco needs the services; the advert period runs from February 14th to February 24th 2023.

Also read

http://How Hackers Disrupted Stima Sacco’s Mobile Banking System

Also read

Sources say Stima Sacco management has directed their focus on investments in the Real Estate sector overlooking investments that are necessary to prevent cybercrime. As a result, they have exposed themselves, becoming a popular target for cybercriminals. Insiders say Stima Sacco lacks skilled security personnel and anti-fraud systems and it has remained open to fraud and a soft spot for cybercriminals.

The yet-to-be-recruited firm is expected to address the hacking of the system which is threatening to bring it down to its knees as members contemplate withdrawing and joining other Sacco due to the security of their hard-earned cash. Despite Sacco’s claim of migrating users to a “new core banking system,” many members have reported difficulties accessing their accounts and funds. This, coupled with reports of possible liquidity problems within the Sacco, has heightened fears about the safety and stability of the institution.To show how serious the matter is, the hackers have totally interfered with the entire system to the extent that withdrawals typically flow from the Sacco to a payment integrator, and then onto Safaricom’s API, which is supposed to alert the Sacco of any suspicious activity, the system has failed.

It remains unclear at this time exactly how the attack was executed, but one thing is certain: this major data breach raises serious questions about the security measures in place at Stima Sacco, leaving its loyal members worried about the safety of their deposits.