During his visit, Clarke met with President William Ruto, National Treasury Cabinet Secretary John Mbadi, Central Bank Governor Dr. Kamau Thugge, and other officials. He also engaged with representatives from Parliament, civil society, business, and development partners, gaining insight into Kenya’s economic challenges and potential paths forward

IMF Deputy Managing Director Nigel Clarke has urged the Kenyan government to ensure the effective use of revenues by bolstering public financial management, governance, transparency, and anti-corruption measures. In a statement following his visit to Kenya from December 8–10, Clarke highlighted the delicate balancing act facing the government as it strives to meet the developmental needs of its citizens while managing a significant debt burden that consumes a substantial share of revenue.

“We continue to encourage engagement with all stakeholders and transparent communication with Kenyans on policy options to build public trust,” Clarke stated, emphasizing the importance of creating fiscal space for investments in social spending, human capital, and inclusivity to enhance economic resilience.

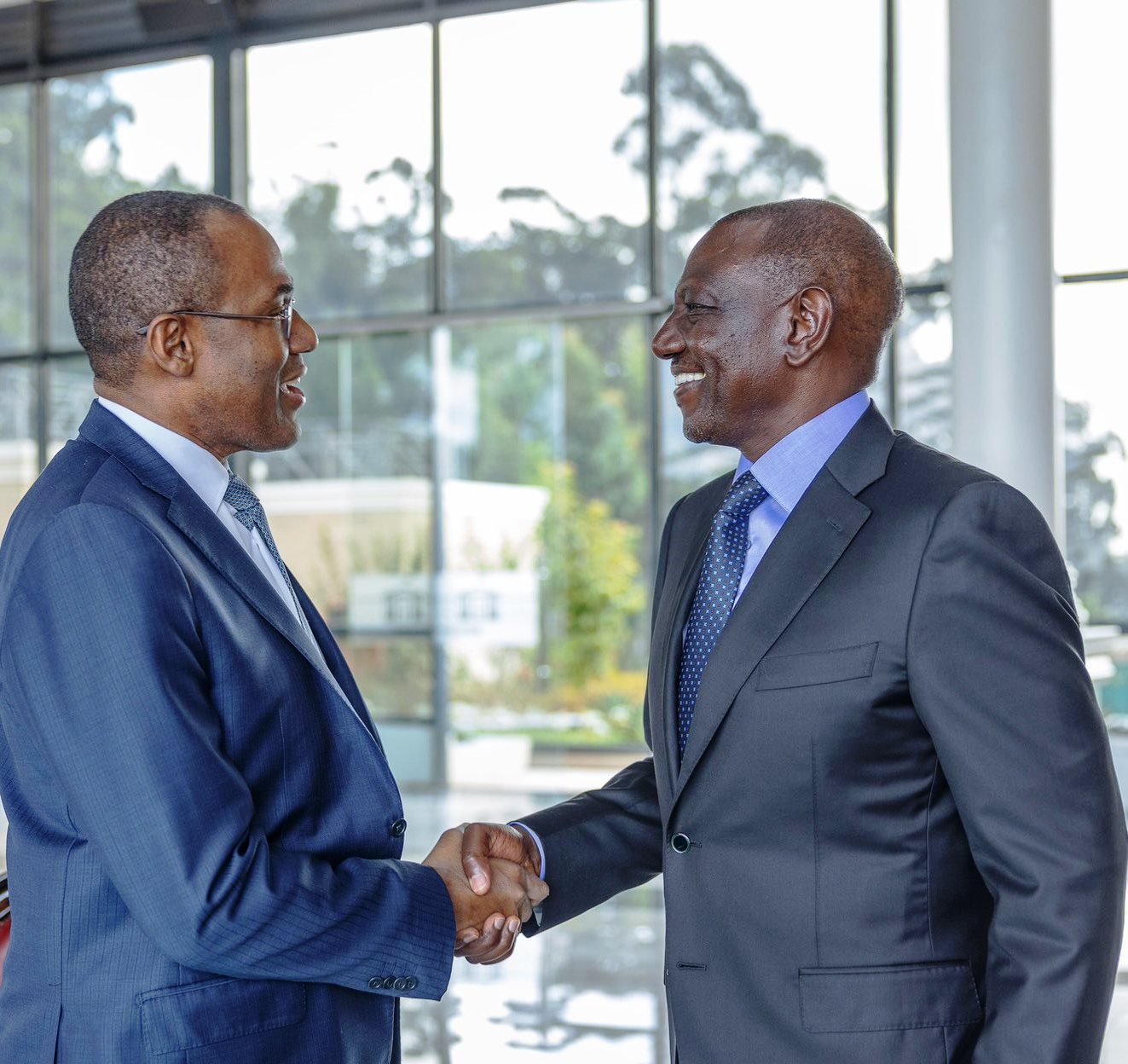

During his visit, Clarke met with President William Ruto, National Treasury Cabinet Secretary John Mbadi, Central Bank Governor Dr. Kamau Thugge, and other officials. He also engaged with representatives from Parliament, civil society, business, and development partners, gaining insight into Kenya’s economic challenges and potential paths forward. “The IMF is committed to supporting policies that unlock Kenya’s economic potential,” Clarke noted, expressing optimism about the dedication of stakeholders to achieving reforms.

Clarke acknowledged that the government’s reform agenda, supported by IMF facilities such as the Extended Fund Facility (EFF), Extended Credit Facility (ECF), and Resilience and Sustainability Facility (RSF), has improved Kenya’s resilience to economic and climate shocks. However, he cautioned that challenges persist, particularly in strengthening fiscal frameworks and reducing debt vulnerabilities.

Among the unmet IMF targets are increasing tax revenue, an area hindered by the collapse of the Finance Bill 2024 following youth-led protests—and tackling corruption and non-performing parastatals. Clarke, however, distanced the IMF from Kenya’s controversial tax proposals, stating, “Specific revenue measures are designed by the Kenyan government, not the IMF.”

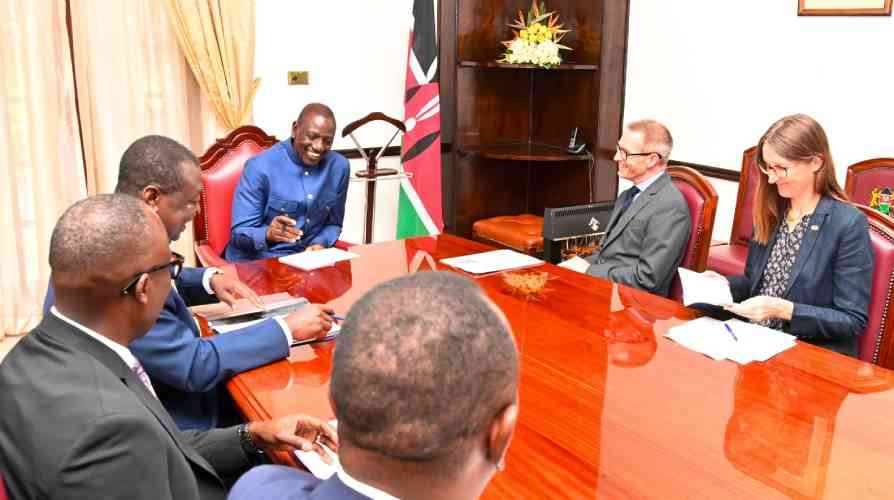

With the current four-year programme set to expire in April, Kenya’s ability to secure further financial support remains uncertain. The IMF withheld two tranches of loans earlier this year but released Ksh 78 billion in October after reforms were implemented. At a State House meeting, President Ruto lauded the IMF and other partners for their support, citing economic improvements: “Our debt burden is easing, inflation is at 2.7%, the lowest in 17 years, and foreign exchange reserves stand at $9.5 billion, the highest ever.”

The next steps in Kenya’s economic journey depend on sustained reform momentum and alignment with IMF recommendations to strengthen the economy and foster public trust.