The investigation revealed that senior executives, including former Managing Director George Ototo, Finance Manager George Owino, and Chairman George Magutu, were allegedly involved in cooking the books, large-scale theft, bribery, and unauthorised bank withdrawals, leaving KUSCCO insolvent by Ksh 12.5 billion

The absence of segregation of duties at Kenya Union of Savings & Credit Co-operatives Ltd (KUSCCO) created a dangerously fertile ground for fraud, enabling a handful of individuals to seize complete control over the organisation’s financial dealings.

This, according to a recently released audit report by PricewaterhouseCoopers (PwC), would culminate in a staggering Ksh 13.3 billion scandal. Experts now speculate that what was once a beacon of trust and co-operative spirit has been torn apart by greed and negligence, leaving behind a trail of financial ruin and shattered confidence.

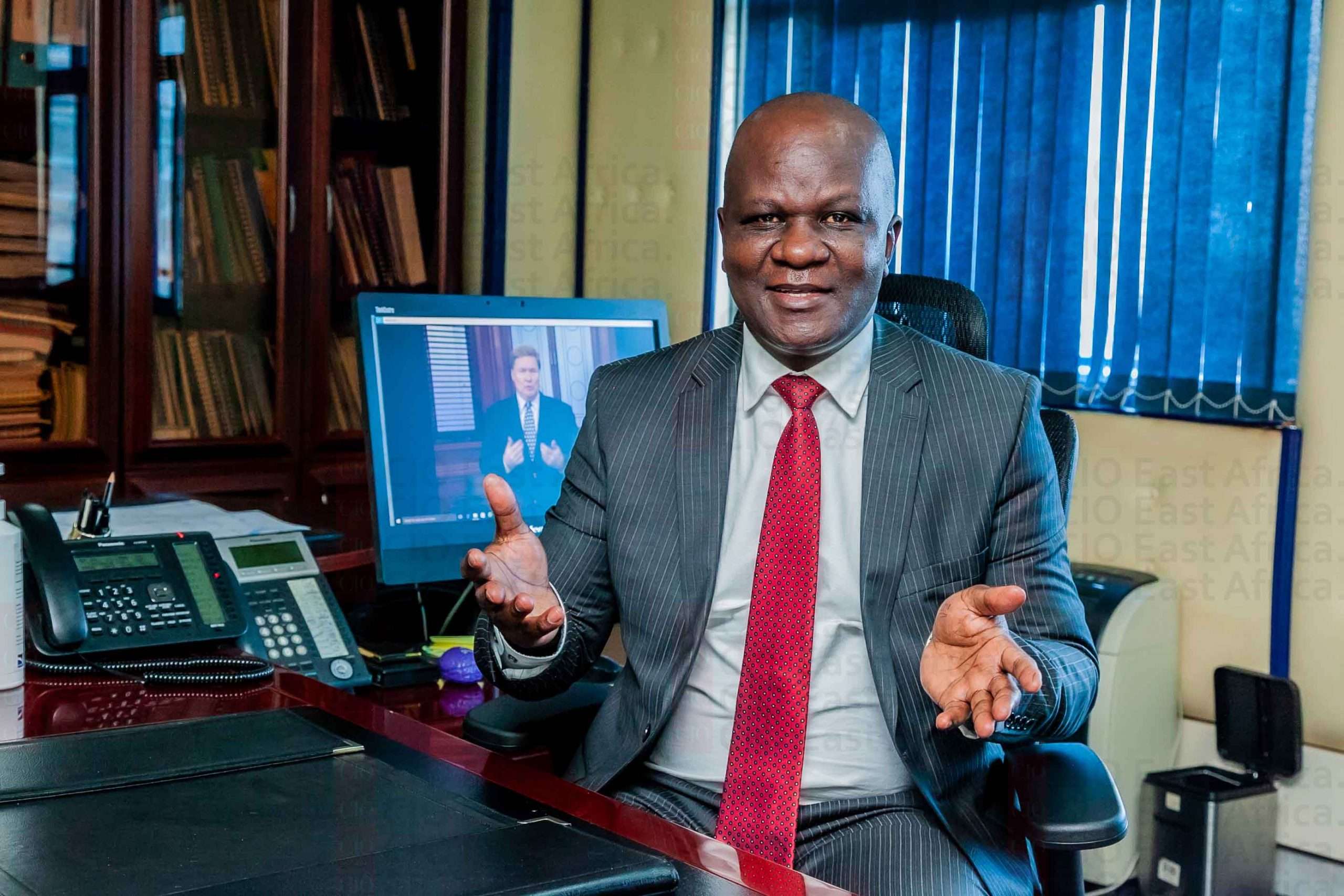

The investigation revealed that senior executives, including former Managing Director George Ototo, Finance Manager George Owino, and Chairman George Magutu, were allegedly involved in cooking the books, large-scale theft, bribery, and unauthorised bank withdrawals, leaving KUSCCO insolvent by Ksh 12.5 billion.

The PwC audit uncovered that KUSCCO’s 2022 financial report had been signed by Alfred Basweti, an auditor from Omenye and Associates, who had been deceased for some time.

The audit revealed Ksh 9.3 billion in misstated accounts, Ksh 6.5 billion in concealed interdepartmental lending, and Ksh 3.7 billion in hidden expenses, putting Ksh 24.8 billion in deposits from 247 SACCOs at significant risk. Additional findings included Ksh 500 million in potentially misappropriated commissions and Ksh 821 million in overpayments to insurance brokers, including Baobab Insurance Agency, which was majority-owned by a former KUSCCO Managing Director.

While the implicated officials have yet to comment, as they are currently facing arrest by the Directorate of Criminal Investigations, which has been probing the scam since last year, the Fintech Association of Kenya has pointed out that systemic vulnerabilities within cooperative ecosystems worldwide are exacerbated by lax oversight, enabling executives to exploit member trust for personal gain.

“Cooperative fraud stems from structural flaws in self-regulation—Tanzania’s 2023 SACCOS crisis and Malaysia’s 1980s Cooperative Central Bank collapse demonstrate how weak governance transforms member-owned institutions into vehicles for ‘Cowboy Capitalism’, akin to the US savings-and-loan debacle,” it remarked on its social media platforms.

David Kiplimo, a Tax Manager at EY, also highlighted the lack of regular audits to identify discrepancies and the absence of accounting and management software that tracks transactions in real time and generates alerts for unusual activities.

“Or was this a classic case of teeming and lading? This shocking revelation puts SACCOs in a very precarious position… A deeply worrying trend,” he noted on social media.

Ototo and Magutu were dismissed last June by then-Co-operatives Cabinet Secretary Samson Chelugui following an inquiry into suspected violations of SACCO regulations, which had implicated them. The two senior officials have since been replaced by David Langat as the new Chairman and Arnold Munene as Acting Managing Director.