Earlier this year, former Cooperatives Cabinet Secretary Simon Chelgui dismissed Kuscco’s entire board following allegations of gross financial misconduct. Sacco leaders accused the union of gross negligence and complicity in the depletion of members’ savings, leaving many contributors financially stranded

The former Chief Executive Officer of the Kenya Union of Savings and Credit Cooperative Society (Kuscco) George Ototo faces a potentially lengthy jail term after an audit revealed the organization’s insolvency. Investigations revealed a staggering deficit of Ksh 12.5 billion.

On Thursday, Kuscco’s interim board handed over a forensic report detailing alleged financial mismanagement within the organization. The report followed an extensive investigation prompted by concerns from Sacco leaders and members demanding accountability.

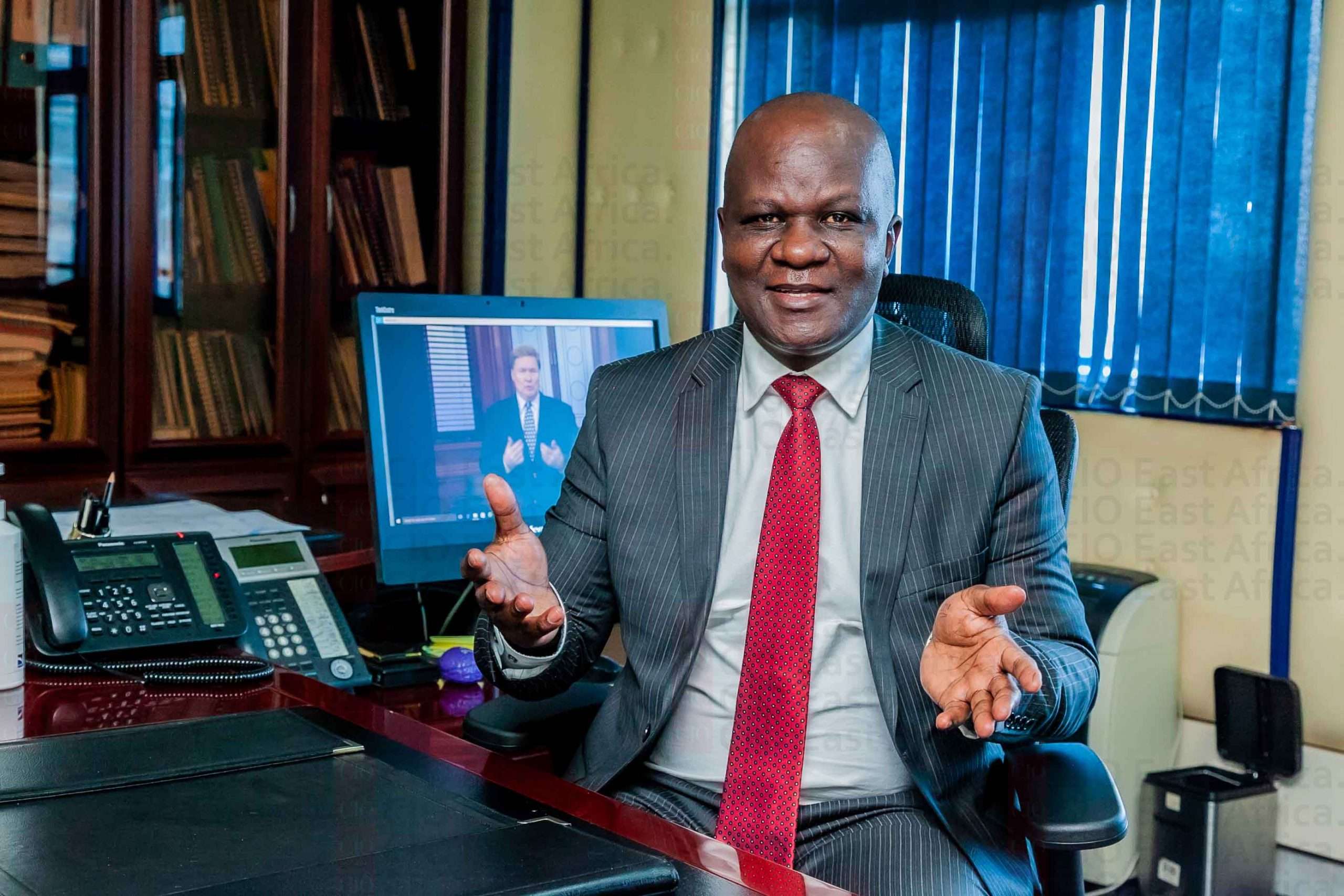

At the report’s handover, Cabinet Secretary for Co-operatives and Small and Medium Enterprises (SMEs) Development, Wycliffe Oparanya, confirmed Kuscco’s dire financial state. He attributed the insolvency to unchecked mismanagement that allowed officials to manipulate financial records, understate expenditures, and siphon funds.

Massive Financial Mismanagement Uncovered

A Grant Thornton audit revealed that top Kuscco officials had been embezzling Ksh 587 million annually between 2013 and 2024. The forensic report outlines numerous irregularities, including transferring money to personal accounts, exploiting weak internal controls, and conducting transactions that collectively cost the institution over Ksh 6.5 billion during the audit period.

Earlier this year, former Cooperatives Cabinet Secretary Simon Chelgui dismissed Kuscco’s entire board following allegations of gross financial misconduct. Sacco leaders accused the union of gross negligence and complicity in the depletion of members’ savings, leaving many contributors financially stranded.

“Kuscco is asking members to accept the situation while urging them to continue saving. What are we supposed to tell our members when they start demanding their money back? The union has failed to address the core issue or provide any assurance that the money will be refunded,” lamented Christopher Wainaina, chairman of PCEA Ruiru Sacco.

Kuscco officials acknowledged their inability to refund the lost funds but claimed they were collaborating with investigative agencies to address the loss. However, this has done little to restore confidence amongmembers. Cabinet Secretary Oparanya vowed to forward the forensic report to the Ethics and Anti-Corruption Commission (EACC), the Directorate of Criminal Investigations (DCI), and the police for legal action.“This is a serious issue. Such cases have greatly harmed our country, where individuals conspire to collapse institutions like Kuscco, which were established to support other Saccos,” Oparanya stated.

He expressed optimism about the Cooperatives Bill, 2024, which is progressing through Parliament. “If passed, the bill will address many of the governance challenges faced by cooperatives, including those that contributed to Kuscco’s collapse,” he added. The Kuscco scandal has highlighted the urgent need for stronger governance and oversight mechanisms within Kenya’s cooperative sector to safeguard members’ savings and prevent future mismanagement.