A palpable sense of dread has swept through the gleaming corridors of “Majani Plaza,” the ultra-modern fortress of the Kenya Tea Development Agency (KTDA), perched along Nairobi’s bustling Koinange Street. Whispers of an impending bloodbath echo through the air-conditioned halls, as rumours of mass staff redundancies, set to strike as early as this month, send shivers down the spines of those within its glass-and-steel walls.

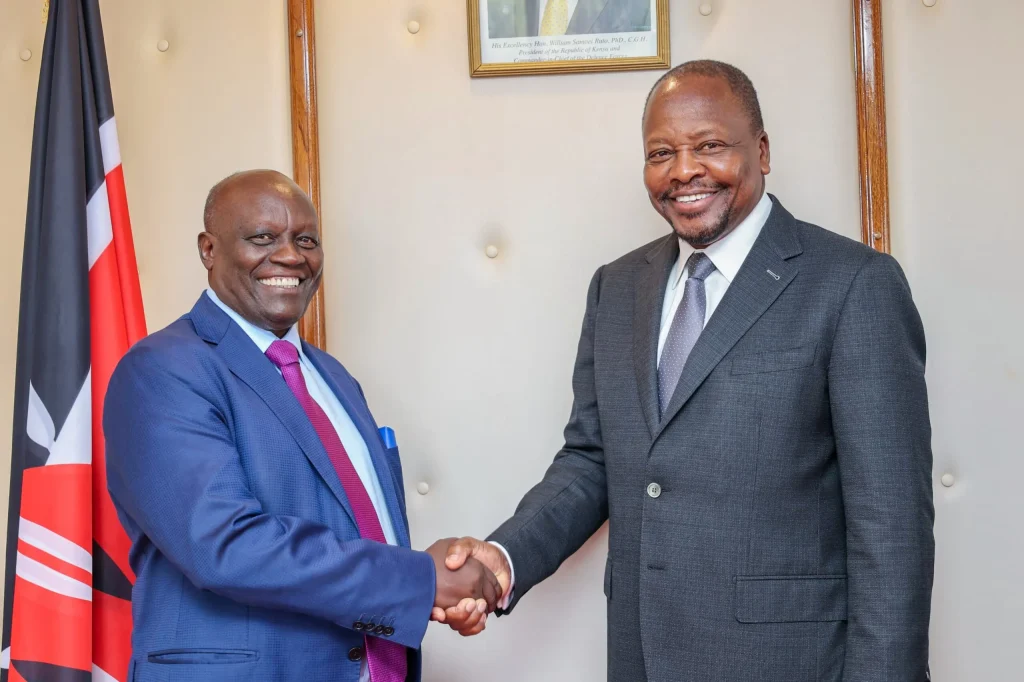

With near unrivalled influence over the KTDA Board, newly appointed Chairman Chege Kirundi has turned his attention to senior managers he views as loyalists of his predecessors, most notably Enos Njeru, whom he ousted from office amid a highly contentious dispute. Njeru, who represents Zone 6 on the KTDA Board, remains a solitary and subdued critic of the new regime.

Under particular scrutiny is the Corporate Affairs department, which is blamed for sharing sensitive information with the press and online commentators. The current Head of Corporate Affairs, Ndiga Githae, hails from Embu County, the same region as Enos Njeru.

Since Kirundi assumed leadership a month ago, there has been a noticeable surge in critical coverage of KTDA and its chairman across mainstream media, alternative outlets, and digital platforms. Githae, once a close ally of Njeru, is said to harbour resentment towards Kirundi for orchestrating what some describe as a takeover against his fellow county native.

Unless unforeseen circumstances intervene, Peter Mungai’s tenure as Head of Procurement appears to be drawing to a close. Doubts linger over Mungai’s allegiance to the new leadership, given his historical connections to Njeru and Kennedy Omanga. Some within KTDA perceive him as a key figure tied to the financial interests of former directors, whom Kirundi has pledged to distance from the organisation.

Procurement at KTDA is a multi-billion-shilling operation, and Kirundi, alongside his supporters on the board, is keen to assert control over this critical department. It oversees significant contracts, such as the upcoming acquisition of 98,000 metric tonnes of fertiliser, valued at over Ksh5 billion.

The transportation of fertiliser from Mombasa Port to various locations nationwide represents another lucrative opportunity for those in charge. The Group Finance Director, Dorcas Mohamed, is also rumoured to be among those facing an uncertain future.