According to the World Bank’s Kenya Economic Update, interest payments now absorb approximately one-third of tax revenues, with total public debt still at high risk of distress despite marginal recent improvements in the debt-to-GDP ratio. Furthermore, the Bank has downgraded Kenya’s economic growth forecast for 2025 to 4.5%, down from earlier projections

By TWV Business Desk

The World Bank has issued a stark warning to Kenya and other African nations regarding the growing risks of relying on fresh borrowing to service existing debt, a strategy it describes as unsustainable and destabilising.

This caution comes amid Kenya’s recent KSh250 billion debt rollover, drawing renewed scrutiny of the country’s fiscal strategy and the resilience of its banking sector. Analysts caution that while rollovers may offer short-term relief, they can compound long-term vulnerabilities by heightening exposure to volatile interest rates and external economic shocks.

Kenya’s public debt remains under intense scrutiny. According to the World Bank’s Kenya Economic Update, interest payments now absorb approximately one-third of tax revenues, with total public debt still at high risk of distress despite marginal recent improvements in the debt-to-GDP ratio. Furthermore, the Bank has downgraded Kenya’s economic growth forecast for 2025 to 4.5%, down from earlier projections.

This revision was attributed to three main factors: high public debt, elevated lending rates, and reduced private sector credit, partly stemming from domestic borrowing crowding out other economic activity. In effect, Kenya’s reliance on rollover mechanisms may be exacerbating financial fragility.

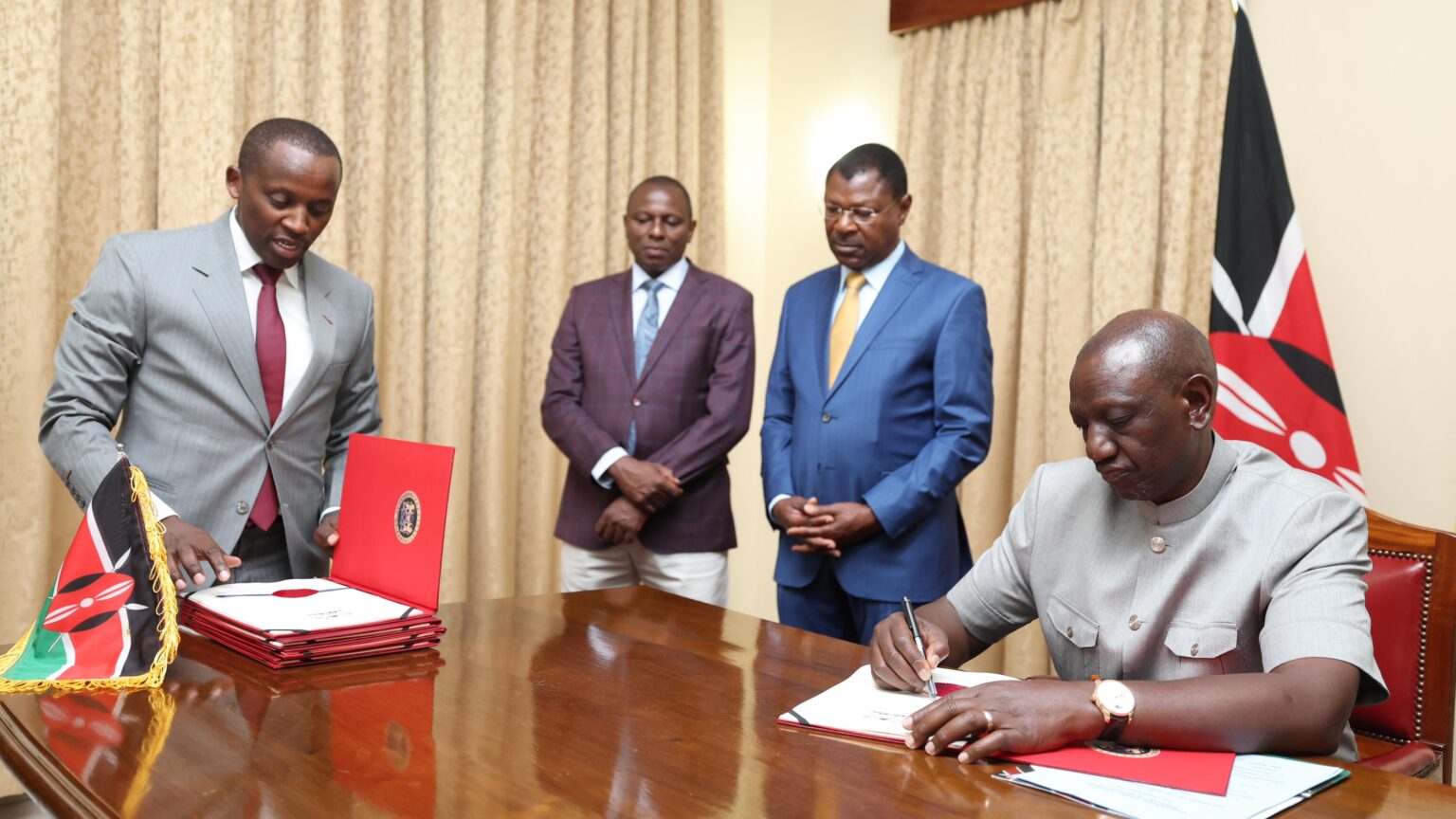

In light of these challenges, the World Bank emphasises the imperative of structural reforms. These include improving revenue collection, consolidating fiscal discipline, and enhancing debt transparency. The Bank estimates that Kenya can reduce its debt-to-GDP ratio to around 44% by 2035, close to the level seen in the mid-2010s, provided it implements targeted reforms encompassing governance, tax base expansion, and more efficient public spending. Such reforms, the Bank contends, could bolster investor confidence, expand fiscal space, and create a more stable environment for inclusive economic growth.

Adding to the pressure, Kenya is exploring alternative financing strategies, including a debt-for-food-security swap worth US $1 billion, and plans to raise US $500 million via sustainability-linked bonds, alongside expected disbursements from the World Bank in the hundreds of millions of dollars. While these instruments may offer short-term breathing space, they also underscore the urgency of addressing underlying fiscal vulnerabilities rather than merely reshuffling liabilities.

In summary, Kenya is at a crossroads: rollover strategies and new borrowing may soothe immediate cash-flow pressures, but without bold, structural reform, they risk perpetuating a cycle of debt dependency. The onus is on policymakers to implement meaningful fiscal discipline and debt management, or else the nation may find itself mired deeper in financial instability.