The Kenya Ports Authority (KPA) achieved a significant leap in dividend payments and operational growth in the fiscal year 2023/2024. The Authority paid Ksh. 10.576 billion in dividends to the National Treasury, a sharp increase from Ksh. 3.341 billion in the previous year. Pre-tax profit also saw a steady rise from Ksh. 16.642 billion to Ksh. 17.284 billion, reflecting KPA’s solid financial performance.

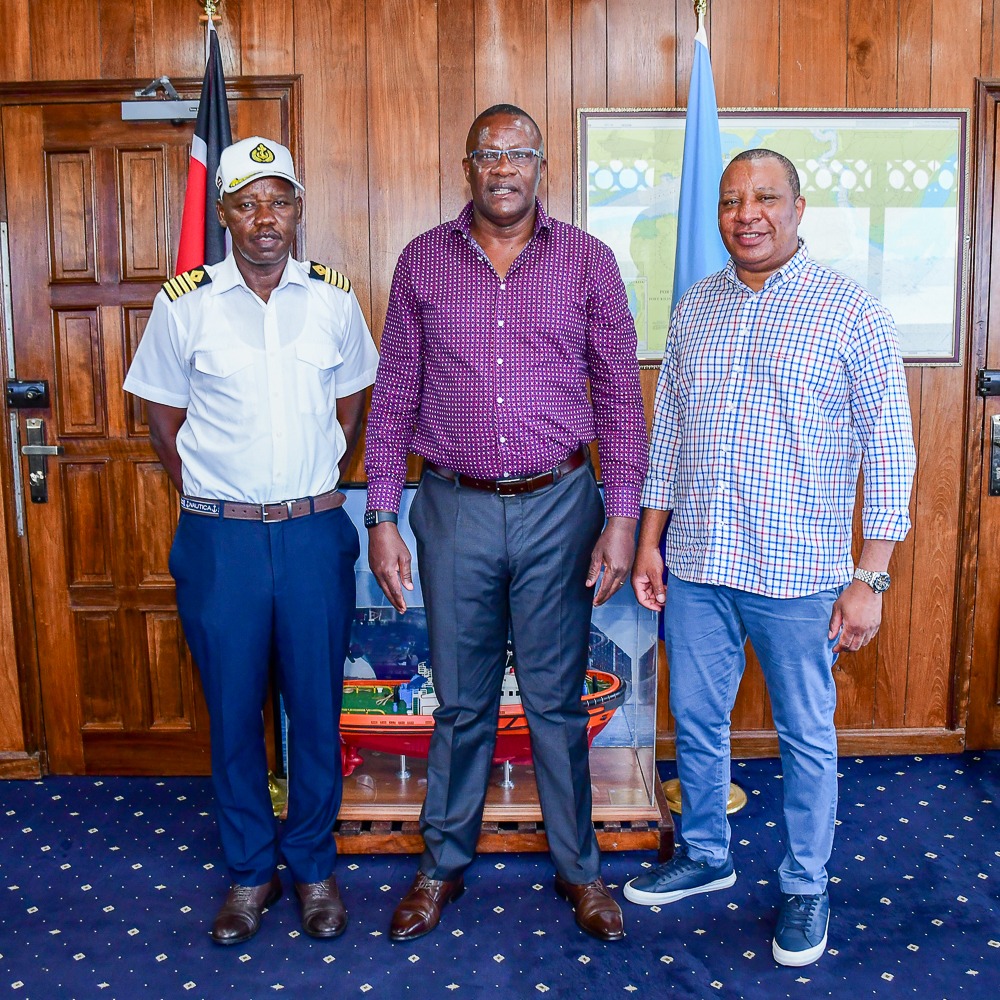

The positive financial outcomes were highlighted during a performance review exercise overseen by Deputy Chief of Staff Mr Eliud Owalo, who was accompanied by the Performance Unit Principal Administrative Secretary Mr Joshua Mwiranga.

However, KPA’s top management pointed out persistent operational challenges stemming from the lack of coordination with other state agencies using the port. One area of concern for KPA management is the operational inefficiency linked to external stakeholders.

“Most of the issues affecting us, especially in operations, stem from other stakeholders and government agencies that we are supposed to collaborate with. If we can establish a seamless operation with these agencies, many of the performance challenges we face will be resolved,” said Mr Benjamin Tayari, Chairman, of KPA.

The Authority called for a reconsideration of the performance evaluation criteria, suggesting that external factors beyond their control, like the effectiveness of other agencies, should be factored in. This would ensure more accurate assessments of their performance and potential solutions to streamline port operations.

KPA Managing Director, Capt. William Ruto said delays in cargo handling and truck turnaround times often stem from other government agencies, clearing procedures, and inefficiencies at checkpoints.

“We have other agencies that are supposed to support us, but they can sometimes derail our operations,” Capt. Ruto said. “We recommend that, moving forward, the evaluation criteria should be adjusted to capture issues that are outside our control. For instance, while the truck turnaround time is supposed to be three hours, delays can occur when trucks arrive and other agencies need to handle the goods, and there are issues such as non-functioning scanners. Therefore, we would like to see future evaluations consider the commitment of these institutions and the external factors that also affect our performance.”

Mr Owalo disclosed that a comprehensive legal framework would soon be in place to ensure that all public institutions justify their existence and meet their mandates effectively.

According to Mr Owalo, the draft Performance Management Bill will require that government organisations demonstrate tangible results in line with their specific mandates. The Bill, once enacted into law, will hold entities accountable by making performance appraisals legally enforceable.

“Organisations must justify their existence in line with their mandate. To augment this process, we are going to anchor performance evaluation and performance management into law,” Mr Owalo emphasised.

“We don’t want a situation where certain organisations don’t deliver on their mandate, and it negatively impacts the performance of other organisations,” Mr Owalo said. “The legal framework will ensure that any agency failing to meet its objectives will face consequences, while high-performing entities will be recognised and rewarded.”

A key feature of the proposed new performance management structure will be the introduction of Service Level Agreements (SLAs) between government agencies.

For example, the Kenya Ports Authority (KPA), which oversees a range of port operations, will be expected to establish clear SLAs with other government agencies that interact with the port infrastructure, ensuring timely and effective service delivery.

“Moving forward, we will ensure that we have service level agreements between Kenya Ports Authority (KPA) and other sister organisations which are also involved in the operations of the port so that each organisation meets its obligations within the stipulated timelines. We will ensure that where we have a multiplicity of players in terms of government agencies, these government agencies will have to enter into service level agreements. This will facilitate efficiency and effectiveness in service delivery so that each entity is committed to meeting timelines,” Mr Owalo said.

Despite these challenges, KPA made significant investments aimed at infrastructure development. In the fiscal year 2023/2024, the Authority invested over Ksh. 1 billion to advance the construction of the Artisanal Fishing Port at Shimoni, increasing its construction from 23% to 67.61%. Cargo throughput also saw a boost, climbing from 34.46 million tonnes to 37.64 million tonnes during the period, demonstrating the port’s growing capacity and efficiency. Return on Investment improved from 4.3 to 4.93 over the same period.

In its five-year strategic plan, 2023/2028, KPA intends to achieve its vision of “World-Class Ports of Choice” as well as providing efficient and competitive port services to facilitate global trade. The Authority has committed to key result areas and strategic objectives as follows:

- Improve port efficiency by 41%

- Promote a safe and healthy working environment with zero accidents

- Increase common transit market share by 7%

- Increase profitability to Ksh. 20 billion by 2028

- Attain a customer satisfaction index of 75%

- Increase employee productivity index to 2

- Promote 100% compliance with legal and regulatory requirements and good governance principles

- Reduce container ship turnaround time to 2.2 days

- Increase total throughput to 38.95 million tonnes by 2028

- Increase transit traffic to 13.218 million tonnes

The KPA’s continued focus on growth signals a future of enhanced productivity and greater economic contributions to Kenya’s maritime sector.