Kenyans are set to enjoy cheaper Fuliza rates from Safaricom after the giant telco lowered the daily fee for loans of between Ksh.100 – Ksh. 500 to Ksh.3, down from the Ksh. 5. Safaricom will also lower the daily charges on loans of between KSh. 1,000 and Ksh.1, 500 to Ksh. 18 from Ksh. 20.

The new rates are expected to help Kenyans access affordable credit as most people have fallen prey to shylocks that offer expensive loans forcing them to be blacklisted by Credit Reference Bureau (CRB) listings. “The lower Fuliza tariffs will see millions of Kenyans and businesses benefit from affordable access to credit enabling them to do more business through M-Pesa,” said Safaricom Chief Executive Officer Peter Ndegwa.

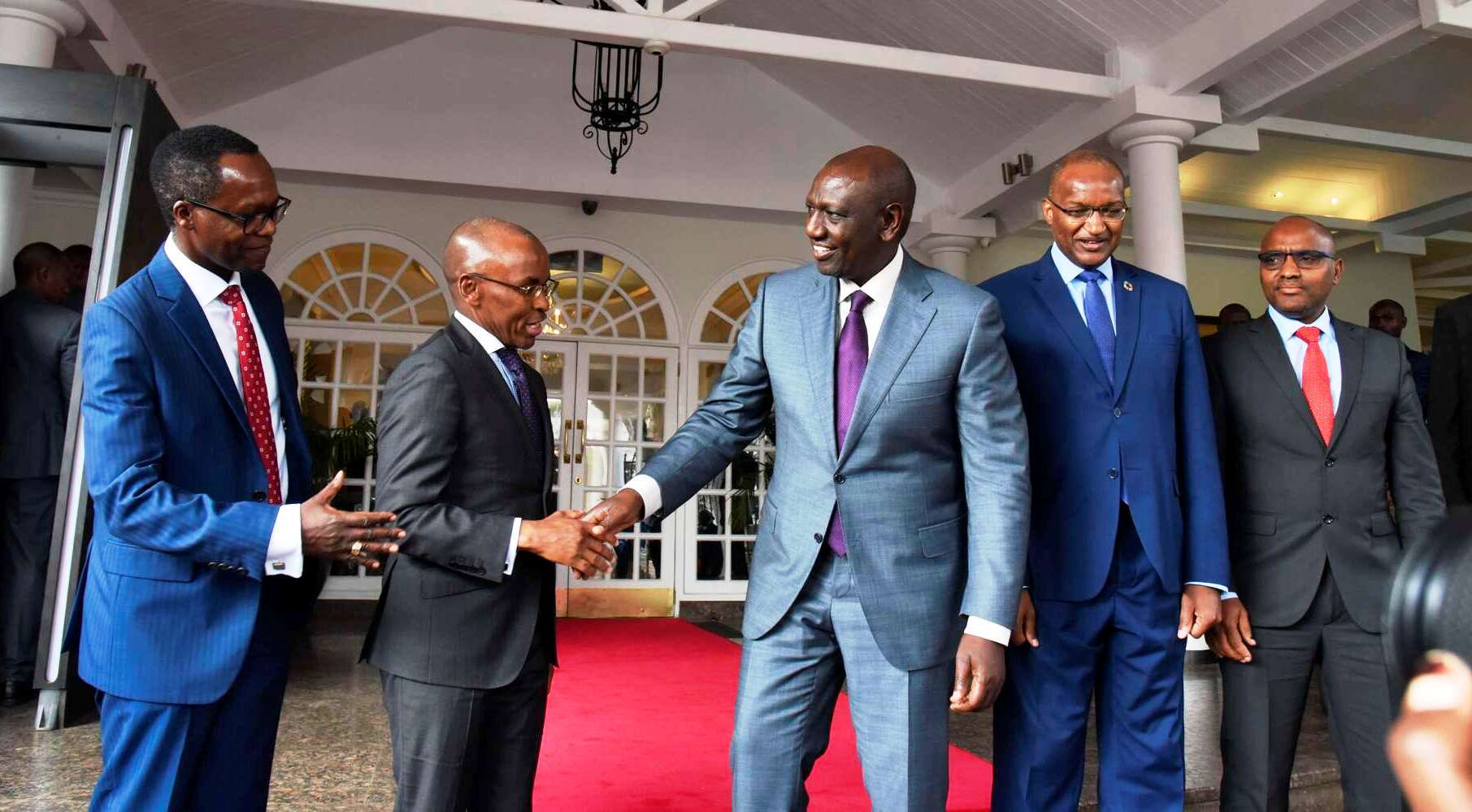

“I am very happy that between four and five million Kenyans will by the beginning of November be out of the blacklisting (by CRBs). That is very important because these Kenyans have been excluded from any formal borrowing because of the blacklisting,” said Ruto

It was noted that Kenyans borrowed Ksh. 502.6 billion in 12 months reinforcing the already known fact that Kenyans have increasingly developed a dependence on borrowing from the facility to meet their daily needs. Four million Kenyans are set to be removed from the Credit Reference Bureau listing for defaulting on their loans after President Ruto pointed out that most Kenyans are getting locked out from having access to credit which has forced many to go for local mobile lenders who end up exploiting them.

“I am very happy that between four and five million Kenyans will by the beginning of November be out of the blacklisting (by CRBs). That is very important because these Kenyans have been excluded from any formal borrowing because of the blacklisting,” said Ruto.

Borrowers will now be assigned credit scores as a move aimed at ending the blacklisting of borrowers by Credit Reference Bureaus (CRBs). “Instead of saying you are in or out, we should have a credit scoring mechanism so we can have a graduated list from the least to the best so that everybody can have a chance even if you are somewhere at the bottom. You can always walk your way up as you learn the ropes,” President Ruto said.