It is claimed that on or around January 2023, the Rwanda Investigation Bureau (RBI), an investigation organ of the Rwandan government, arrested and detained them, along with over 100 other Rwandan residents who are customers of MasterCard and I&M, for more than three months without trial. The RBI officers extorted them, confiscated their properties, and denied them bail. According to the lawyer, all the victims who were clients of MasterCard or I&M as users of the MasterCard Multi-currency Prepaid Card issued by the I&M Bank have been detained in Rwanda without trial over alleged banking fraud, money laundering, and illicit enrichment

By The Weekly Vision Team

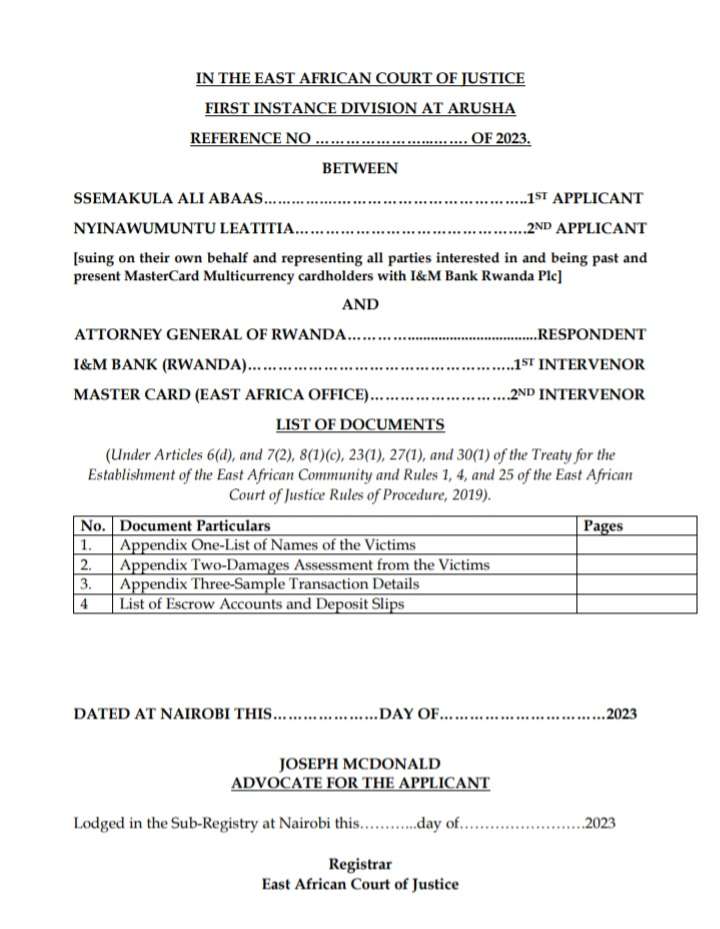

A lawsuit has been filed at the East Africa Court of Justice (EACJ) against MasterCard, I&M Bank, and the government of Rwanda for allegedly committing acts of extortion, unlawful imprisonment, and torture against 150 cardholders in clear violation of their rights. MasterCard and the two entities from Rwanda are being accused of engaging in unlawful activities that have caused harm and suffering to the affected individuals.

The case was submitted in court by the law firm of McDonald and Company Advocates based in Kenya on behalf of the 150 individuals by two applicants, Ssemakula Ali Abaas and Nyinawumuntu Laetitia from Uganda and Rwanda respectively. The respondents in the case are MasterCard, I&M; Bank, and the Rwanda Investigation Bureau. They are accused of complicity in the arbitrary arrest, detention, extortion, and torture of users of the MasterCard Multicurrency Prepaid Card.

It is claimed that on or around January 2023, the Rwanda Investigation Bureau (RBI), an investigation organ of the Rwandan government, arrested and detained them, along with over 100 other Rwandan residents who are customers of MasterCard and I&M, for more than three months without trial. The RBI officers extorted them, confiscated their properties, and denied them bail. According to the lawyer, all the victims who were clients of MasterCard or I&M as users of the MasterCard Multi-currency Prepaid Card issued by the I&M Bank have been detained in Rwanda without trial over alleged banking fraud, money laundering, and illicit enrichment.

The dispute revolves around a group of Rwandan citizens who entered into a bank/customer relationship with I&M Bank Rwanda PLC when the bank issued them a Mastercard multi-currency card. It is alleged that between November 2022 and January 2023, I&M Rwanda issued prepaid MasterCards to the victims. The card allowed the holder to pay for goods and services from merchants displaying the sign corresponding to that appearing on his or her card.

It is claimed that one of the benefits advertised on the bank’s website is that a cardholder could shift one currency to another within the card’s sub-wallets. According to affidavits sworn by Abaas and Laetitia, a comparison between the rates offered by the bank and those on the MasterCard platform revealed that the latter offered favourable rates.

They further revealed that the card also allowed the holder to withdraw banknotes in Rwanda in local currency and abroad, in the currency of the country concerned, from member banks, financial institutions, and automated teller machines (ATM) displaying the sign Mastercard.

The court papers further revealed that the group would then develop the practice of shifting currencies within the card’s sub-wallets, i.e., from AED to EURO and back to AED, resulting in a 10 per cent profit. However, while using the cards, they discovered that they could make a profit by buying and selling the currencies in their respective wallets. This activity essentially leveraged price differences across markets, a practice known as arbitrage. Further, they alleged that I&M had run a commercial advertisement that gave customers a 10 per cent discount on the usage of their multi-currency card. It is reported that the trade was so lucrative that some players made millions of dollars in profit and began living lavish lifestyles, which attracted the attention of Rwandan authorities.

In his affidavit, Ali, a Ugandan national, stated that he was such a trader and is still surprised that he was arrested on January 9, 2023, at the Gatuna Rwanda-Uganda border while on his way to Kampala. Ali further revealed that since his arrest, together with his sister and three other countrymen, they have been detained for more than three months without trial and denied bail.

After their dramatic arrest, RBI proceeded to detain them, and subsequently, with the help of Mastercard and I&M, it identified and arrested another 150 cardholders who were also involved in the forex trade. They further claimed that after arrest, they were tortured, their bank accounts emptied, cash forcibly taken from them, and then detained without trial. “Since our arrest, the Rwandan government has been extorting and forcing us to transfer money to escrow accounts,” Abaas says. The traders further revealed that the Rwandan government has also confiscated their properties, and their family members and friends, including all other cardholders, have been detained and tortured to forcefully give information on the matter.

They argue that besides violating national laws, the Rwanda Investigation Bureau’s actions procedurally and substantively obstructed their right to access justice as enshrined under Article 24 of the Constitution of Rwanda. They now want the East Africa Court of Justice (EACJ), based in Arusha, Tanzania, to issue various orders, including a declaration that their arrest and detention by the Rwanda Investigation Bureau infringed on their constitutional rights.

The prayers sought by the applicants read A declaration that the acts by the Respondent either by itself, their agents, servants, or personal representatives to illegally arrest, detain, and torture friends and family members of the applicants contravenes Article 6(d) and 7(2) of the Treaty.”.

The applicants further seek interim orders stopping the Rwandese government, Mastercard, and I&M, either by themselves, their agents, servants, or personal representatives, from further infringement of the fundamental principles of the EAC Treaty, including the immediate cessation of any dealing with the properties of the applicants, such as selling or auctioning them.

Reports indicate that early this year, the I&M Bank Rwanda unit announced it lost $10.3 million to “fraudulent customer withdrawals between November 1, 2022, and January 17, 2023, triggering investigations in an attempt to recover the amount. According to financial experts, this amount was more than the $7.6 million net profit that I&M Group had generated from the Rwandan market in the financial year ending December 2022. The I&M Group, in its Annual Report and Audited Financial Statements for 2022, disclosed the incident of “fraud” in Rwanda.

Subsequently, the management of I&M Bank (Rwanda) PLC discovered incidences of fraudulent withdrawals through customer wallets amounting to USD 10.3 million during the period between November 1, 2022, and January 17, 2023.

Reports indicate that I&M Bank (Rwanda) rolled out the multi-currency Mastercard prepaid debit card in 2019, enabling users to load funds in 15 different currencies with no foreign exchange fees. Further, the cardholders have insisted they did not commit fraud or engage in any criminal activity. “I have never impersonated myself in requesting the card, using it, or committing any fraud to acquire it. I fulfilled the requirements in the right way; the card was issued to me at the price of RWF 35, 000,” said Abaas.

Contrary to claims by the bank, Abaas revealed that the interest (profit) was “generated after selling the money (RWF) into other currencies, and it was legal as the forex rate was provided by the bank solely and it could modify the rate in its sole discretion.