The recent objections by a section of MPs to certain provisions of the Finance Act 2023 have sparked scrutiny into their initial support for the same, raising questions about potential outside pressures on them during the voting process. Kandara MP Chege Njuguna and Gatanga MP Edward Muriiu, both of whom initially voted in favour of the Act, joined forces on February 26, 2024, with local farmers to halt an awareness campaign by Kenya Revenue Authority (KRA) officials.

The campaign aimed to educate farmers on the requirement for businesses to electronically generate and transmit invoices to KRA through the electronic Tax Invoice Management System (eTIMS).

Despite their earlier support for the Act, MP Njuguna expressed strong opposition to certain tax measures affecting farmers during the gathering. He emphasized the need for government subsidies to support farmers rather than imposing burdensome taxes. However, the Finance Act 2023, specifically Section 23A, empowers the Commissioner to establish an electronic system for issuing tax invoices, including for businesses. This discrepancy between the MPs’ recent actions and the provisions of the Act has raised questions about the thoroughness of their initial review and voting process.

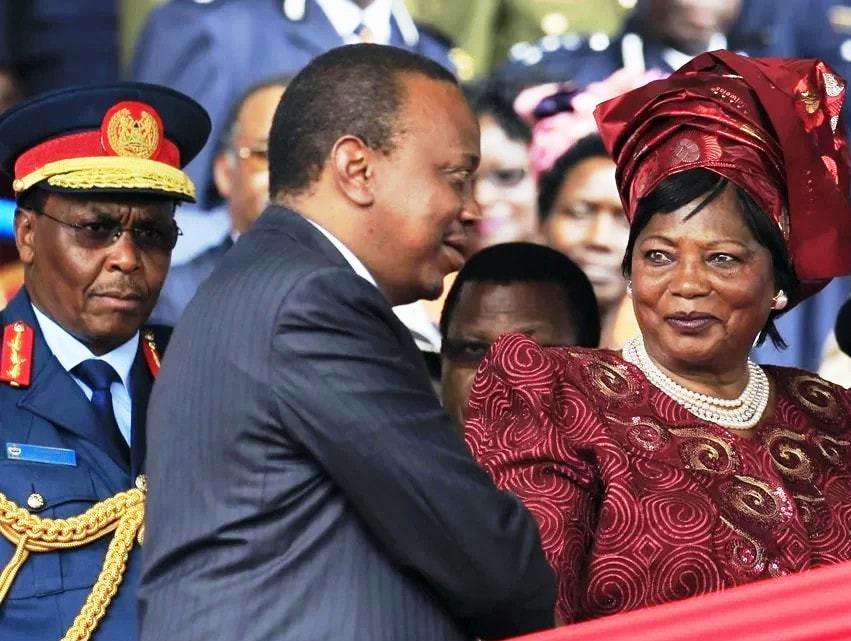

The conflicting positions within the ruling party were also evident, with Deputy President Rigathi Gachagua acknowledging the need for a review of certain provisions affecting farmers. This inconsistency underscores potential challenges in the implementation of tax measures and their impact on different sectors of the economy. The genesis of this controversy traces back to statements made by President William Ruto, urging MPs to support the bill during its tabling in parliament. Despite initial resistance from some MPs, the bill ultimately passed with a significant majority, highlighting the complexities of party dynamics and legislative decision-making.

As Kenyans grapple with the implications of the Finance Act 2023 on their financial burdens, the evolving stance of MPs and political leaders underscores the ongoing debate surrounding taxation policies and their alignment with broader development goals.